Consumption Forecasting: What It Is & How to Do It

Last updated on Friday, May 16, 2025

Consumption forecasting is no longer a niche strategy, it’s a necessity for SaaS, IaaS, and digital service companies adopting usage-based pricing. Whether you’re a subscription-based business shifting toward pay-as-you-go, or a company already operating on variable billing, accurate consumption forecasting is the key to revenue visibility, customer growth, and long-term profitability.

This guide will walk you through the fundamentals of consumption forecasting, its role in modern revenue operations, the common pitfalls to avoid, and how platforms like revVana + Salesforce enable smarter forecasting with real-time consumption data.

What Is Consumption Forecasting?

Consumption forecasting is the process of predicting future usage patterns of a product or service to estimate revenue, guide operations, and align business resources. In usage-based models, where customers are billed according to actual consumption, such as API calls, storage volume, minutes used, or transaction volume, forecasting usage becomes essential to managing cash flow, capacity planning, and strategic growth.

For example, a SaaS healthcare platform like ZocDoc might charge based on the number of patient bookings per provider. By analyzing historical booking trends, seasonality, and customer behavior, ZocDoc can anticipate future usage and better plan its revenue and operations.

Source: Why do SaaS companies with usage-based pricing grow faster?

Why Is Consumption Forecasting So Important?

The prevalence of consumption or usage-based pricing models in the B2B SaaS sector has significantly increased, nearly doubling in the past 5 years. Currently, 60% of companies have implemented or are experimenting with a consumption model, signaling a shift towards this flexible pricing strategy. But what caused this?

Source: Usage-Based Pricing: The next evolution in software pricing.

There has been a notable shift in purchasing dynamics within enterprise SaaS. The decision-making power has largely shifted to the individual users within organizations, who are part of business or engineering departments. These individuals prefer to assess the value of a SaaS product through direct use before committing financially. The move towards consumption, or usage-based pricing directly responds to this shift, offering an entry point at minimal or no initial cost, with expenses scaling alongside usage.

Modern software development trends are increasingly aligning with the principles of usage-based models, advocating for billing based on consumption rather than per user.

Financial leaders need to gain a more robust command of these demand signals from the front office to manage investments and operations, aligning to when revenue will get recognized. Notably, this analysis identified two dozen post-booking variables that are confounding the revenue forecasting process and generating significant revenue leakage, shrinkage, and slippage after a customer commitment has been made. These include information about customer consumption, onboarding, service, success, rollouts, and adoption that are impacted by the front office teams in sales and service.

So to summarize, this shift was caused by:

Customer-driven buying: Enterprise buyers now prefer to test and scale usage incrementally.

Flexible entry points: Customers are more likely to convert with low upfront commitment.

Higher revenue growth: Usage-based companies report up to 38% higher YoY growth compared to fixed-price peers.

Improved retention and NDR: Aligning price to value drives better net dollar retention and lowers churn risk.

Why Move to a Consumption Model?

Choosing the right pricing strategy is essential, as it influences everything from strategic priorities and product development to your revenue stream. It might seem surprising, but adopting a consumption model could lead to a 38% increase in YoY revenue growth.

Source: Usage-Based Pricing: The next evolution in software pricing.

At the heart of the consumption model is the understanding that it’s impossible to predict which accounts will grow the largest. By choosing usage-based pricing, your company places multiple bets, hoping some will yield exceptional returns. This approach necessitates offering an outstanding user experience to everyone who signs up, regardless of their initial investment.

SaaS companies that employ usage-based pricing often grow more quickly because of their customer acquisition cost and net dollar retention rates. These results illustrate why usage-based pricing is gaining traction in the market.

Why Forecast Consumption?

Forecasting consumption is pivotal for several reasons:

Identify Churn and Upsell Opportunities: By understanding usage patterns, businesses can pinpoint customers at risk of churn and identify opportunities for upselling additional services. For example, a SaaS company offering a tiered subscription model can monitor customer usage to suggest a more suitable plan, either upgrading to avoid overages or downgrading to avoid paying for unused services, leading to better customer satisfaction and retention.

Revenue Recognition: Accurately forecasting consumption helps in recognizing revenue more precisely for individual customers, determining when revenue will be realized. I.e. a telecommunications provider uses consumption data to forecast monthly revenues from variable data plans, accounting for seasonal fluctuations in usage, such as higher consumption during holiday seasons.

Sales and Performance Feedback: Actual usage data feeds back into the sales process, allowing teams to adjust their strategies based on whether customers are under or over-utilizing services. A company can analyze usage patterns and identify departments within a client organization that are not fully utilizing their services, prompting targeted training sessions to increase adoption and satisfaction.

Pricing and Compliance: Accurate forecasting prevents billing discrepancies, ensuring customers are charged fairly according to their usage tier, and avoiding compliance issues. Here’s an example for a cloud storage provider: They monitor customer data usage against their subscription tier, automatically notifying customers as they approach their limit. This approach prevents overage charges, promotes fair billing, and offers the opportunity to upgrade, enhancing transparency and trust with clients.

Key Challenges in Forecasting Consumption

Despite its benefits, consumption forecasting is complex. Here are common hurdles companies face:

Disparate Data Sources: Most teams rely on fragmented tools like spreadsheets, CRM exports, or siloed BI dashboards, creating inconsistent forecasts and hours of manual reconciliation.

Lack of Real-Time Signals: Without integrating real usage data into forecasting models, teams operate on guesswork instead of up-to-date consumption behavior.

No Fixed Contracts: In the absence of annual contracts, forecasting becomes a continuous process. Teams must monitor usage frequently and adjust models dynamically.

Departmental Silos: Sales, operations, and finance often operate independently, using different metrics and data definitions. This lack of collaboration leads to inaccurate, delayed forecasts.

How to Build a Strong Consumption Forecasting Framework

To succeed with consumption forecasting, businesses need to integrate five core capabilities:

- Unified Revenue Data: Combine CRM data with product usage logs in a centralized platform.

- Automated Forecasting Models: Leverage statistical and AI models to project usage based on historical and real-time trends.

- Customer Segmentation: Forecast usage by customer tier, industry, or geography for deeper insight.

- Scenario Planning: Model best, worst, and expected usage paths to guide planning and cash flow.

- Closed-Loop Feedback: Enable sales, finance, and success teams to collaborate using the same live data.

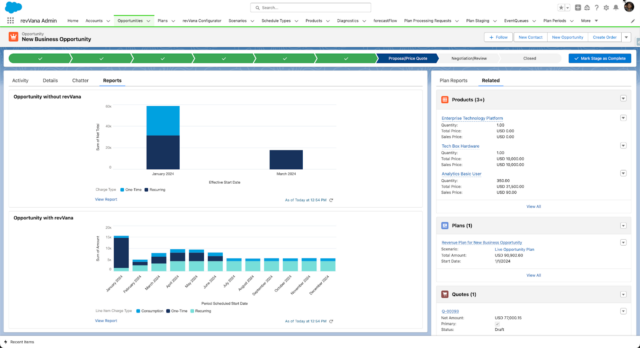

Consumption Forecasting with revVana and Salesforce

revVana delivers native consumption forecasting in Salesforce, giving you an end-to-end forecasting engine that blends booked, forecasted, and actual revenue in one place.

Here’s how revVana helps:

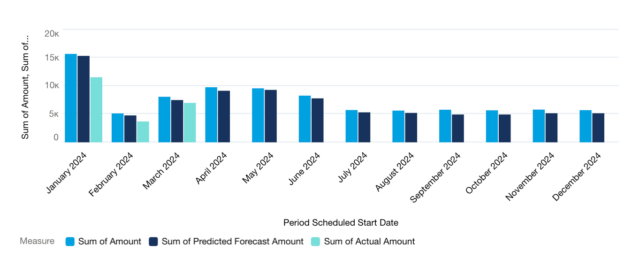

Forecast and Compare Actuals

Pull in live usage data and compare it to forecasts in Salesforce. Spot deviations in real time and adjust your outlook on the fly.

Forecast Hybrid Revenue Models

Whether it’s fixed subscription, usage-based, or milestone-based revenue, revVana lets you forecast across all streams in a single view.

Improve Customer Engagement

Use forecasting insights to identify customers at risk of churn, flag overages, or proactively offer upsell recommendations.

Enable Predictive AI Models

Plug in machine learning models to forecast consumption patterns based on seasonality, user behavior, or external factors.

See it in action:

As SaaS evolves, consumption forecasting is becoming the cornerstone of scalable revenue operations. It helps you forecast cash flow, optimize pricing, personalize engagement, and align every team around the same revenue truth.

The good news? You don’t need to overhaul your stack. With revVana, you can integrate consumption forecasting directly into Salesforce, combining forecasting accuracy with operational simplicity.

Ready to dive deeper?

Consumption Forecasting: What It Is & How to Do It

Published on Friday, May 16, 2025