Dynamic Forecasting Report

Last updated on Friday, August 4, 2023

A more agile, reliable, and approach to revenue forecasting in a modern commercial model.

Executive Summary

It’s a wild new world, and CEOs are under more pressure than ever to deliver consistent long-term revenue in an increasingly uncertain market. In response, organizations are getting creative to manage a mix of new business revenue streams

The result? Accurate and timely forecasting is all but impossible for organizations relying on traditional methods.

In a study conducted by our partners at the Revenue Enablement Institute, 64% of finance executives believe that forecasting revenues and business performance has become more complex in the past year, and 54% believe it will only become more complex in the future.

This complexity is resulting in:

- No visibility to key signals of customer demand, consumption, retention or expansion

- Forecasts taking too long to build, leading to outdated and unreliable forecasts

- Overcomplicated forecasting processes that aren’t agile enough to respond quickly as things change

- Inability to manage investments and operations in alignment with when revenue will be recognized

In this comprehensive report, you’ll learn how these 3 problems are showing up in modern companies, and how leaders are rethinking the way their teams manage and forecast revenues.

You’ll also learn how new dynamic forecasting methods:

- You’ll also learn how new dynamic forecasting methods:

- Automate the forecasting process for near real-time reports

- Bring transparency to the data and aligns processes across your organization

- Deliver more accurate forecasts

- Provide finance teams with the agility to respond to changes, improving management of investments and operations

The Pressure to Generate More Consistent 4 and Profitable Growth

“CEOs are under pressure from their boards and shareholders to ensure predictable and profitable growth in an increasingly uncertain market because more consistent revenue streams have become critical to increasing the value of their enterprises.”

This quest for growth has led most business-to-business organizations to pursue longer-term contracts and repackage their offerings with pricing and revenue models that closely align with their customers and generate more stable revenue streams.

This pressure on CEOs to deliver consistent long-term revenue streams has led most businessto-business organizations to put increasingly sophisticated relationship structures with customers that involve multiple points of value delivered on a one-time or continual basis. As a result, CEOs, CFOs, and operations leaders now face various challenges as they attempt to manage a mix of new business revenue streams. These include a blend of products, services, and one-time sales combined with consumption-based contracts, time-based projects, and subscriptions. These include:

- Accounting teams struggling to close the growing gap between committed and realized revenue;

- Finance teams struggling to reliably forecast future revenue accurately over time;

- CFOs struggling to reallocate and plan sales, production, and delivery capacity in the face of increasing market uncertainty to maximize the return on these assets.

They find this “business as usual” approach increasingly challenging to manage revenue and margins and are actively transforming their operations to become more agile, automated, collaborative, and data driven.

This analysis explores the combination of elements driving the transformation of the commercial model. These elements force the front-office sales, account management, product, and services teams to work more closely with the back-office finance, controller, and financial planning functions to expand customer revenue.

The Forces Compelling the Front and Back 5 Office to Work Together to Expand Customer Revenue

While it would be easy to blame these problems on one thing – say, the economy or raw material shortages – the reality is that a combination of systemic factors forces financial leaders to change their approach to managing revenue in a modern commercial model. In all, six forces are driving the transformation of the commercial model.

- Pressures to improve the experience, lifetime value, and loyalty of customers

- Growing uncertainty about the external market environment and customer behavior

- Increased accountability for financial returns on growth assets

- The digitization and automation of core commercial processes

- The alignment of customer-facing functions – and the data, systems, and operations that support them – along the revenue cycle

- A revolution in advanced analytics in sales and finance

Collectively, they are forcing front-office sales, account management, and product and services teams to work more closely with the back-office finance, controller, and financial planning functions to expand customer revenue.

The primary problem is that the increased complexity of these revenue models, combined with the uncertainty of planning several years in the future, has made the ability to forecast effectively an even more significant challenge. 63% of finance executives believe the complexity of forecasting revenue and business performance has increased over the past year. And most (54%) agree it will only become more complex in the future, according to a survey of 551 finance executives by the AICPA.9

As organizations pursue more predictable and consistent long-term revenue streams, they are putting in place increasingly sophisticated relationship structures with customers that involve multiple points of value delivered on a one-time or continual basis.

As a result, CEOs, CFOs, and operations leaders face various challenges as they manage a mix of new business revenue streams. These streams can include a blend of products, services, and onetime sales combined with consumption-based contracts, time-based projects, and subscriptions.

For example, consumption-based revenue is hard to predict because a customer’s consumption 6 is often tied to their customers’ demand. In addition, continual basis revenue (recurring) presents challenges on when revenue is earned, not necessarily when billed or when money is received.

At the same time, finance teams must forecast their existing books of business, which include run-rate, on-account, and seasonally adjusted orders. This makes it challenging to provide management and investors with the visibility into future demand, revenue, capacity, and resource requirements to manage profitable growth effectively.

The recurring, usage, and time-based revenue streams are increasingly dependent on downstream variables like onboarding, rollouts, adoption, consumption, delivery, service, and success that are impacted by the front office teams in sales and service. As a result, managing and forecasting these sophisticated relationship structures, along with the associated usage and time-based revenue streams they create, is complex. In addition, these structures depend heavily on frequently changing customer variables at every stage of the revenue cycle – from upstream business development to downstream ramp and run rate forecasts.

Financial leaders need to gain a more robust command of these demand signals from the front office to manage investments and operations, aligning to when revenue will get recognized. Notably, this analysis identified two dozen post-booking variables that are confounding the revenue forecasting process and generating significant revenue leakage, shrinkage, and slippage after a customer commitment has been made. These include information about customer consumption, onboarding, service, success, rollouts, and adoption that are impacted by the front office teams in sales and service.

Unfortunately, most financial leaders lack the visibility into these critical signals of customer demand, consumption, retention, and expansion they need to manage and optimize revenue effectively. Most organizations struggle to get accurate demand indicators at every revenue cycle stage because they lack established cross-functional processes where front-office sales, product, and service teams can collaborate and share information with finance. The traditional spreadsheetbased approaches most organizations use to gather, aggregate, share and analyze demand data are too slow, inefficient, and error-prone to support revenue management and forecasting these revenue streams. By the time the forecast analysis is ready, it is outdated and unreliable. As the volume and frequency of post-booking changes to contracted revenue continue to increase, a more dynamic method is needed.

The increased uncertainty of the macroeconomic environment – combined with the inability to quickly adjust manual revenue recognition, forecasting, and reporting processes – has compounded the problem. It becomes challenging for finance teams to accurately plan and forecast future revenue in an increasingly uncertain market. A perfect storm of post-pandemic dynamics – global supply disruptions, inflation, and geo-political shifts – has organizations feeling whiplash in sourcing, building, and delivering to an increasing variable demand pattern. Most (61%) of CFOs are 7 currently pessimistic about the US economy over the next six months, according to a survey of 249 CFOs by Grant Thornton.3 Even more financial leaders (70%) lack confidence in their organization’s ability to pivot and adapt to disruptive events, according to a survey of 2,260 private and publicsector CxOs by Deloitte.7

As a direct outcome, most (57%) senior financial executives are actively accelerating the pace of forecasting in their business in the face of market opportunity and economic headwinds, according to a survey of 551 CPAs in leadership roles, 42% of whom are CFOs, by the Association of International CPAs (AICPA).9 “The frequency of forecasting is on an upswing as financial leaders grapple with inflation, interest rate hikes by the Federal Reserve, and supply chain uncertainty,” states Tom Hood, the EVP of Business Engagement and Growth at the AICPA.13

Most organizations struggle to get accurate demand indicators at every revenue cycle stage because they have created specialized silos across the core teams that support the revenue cycle – including product, sales, service, account management, finance, and the operations that support them. The fragmentation of data, processes and team structures across these silos makes it difficult for critical demand data to flow between the front and back offices. Two-thirds (67%) of the finance executives said finance leadership should better align with sales leadership to improve forecasting and maximize revenue growth.

Figure 1. The Forces Transforming the Commercial Model

Improving the experience, lifetime value, and loyalty of customers

To generate more consistent revenue growth and customer lifetime value, organizations are moving to more sophisticated relationship structures with customers that involve multiple points of value delivered on a onetime or continual basis with a blend of products, services, solutions, and subscriptions

Growing uncertainty about the market environment

CFOs must plan, allocate, and protect assets and resources in the face of global supply disruptions, geo-political shifts, and increasing variable demand patterns. Most CFOs (61%) are not optimistic about the US economy over the next six months, and even more (70%) lack confidence in their organization’s ability to pivot and adapt to disruptive events.

Accountability for financial returns on growth assets

Increased pressure to prove the contribution of growth assets to firm financial performance will fundamentally change how growth resources/assets are allocated, organized, funded, and measured and focus technology strategies on improving returns on the sales, delivery, and success assets.

The digitization and automation of core commercial processes

31% of CFOs are making it a high priority to integrate their finance processes from the back office to the front offices across organizational hierarchies. 68% of CFOs are exploring new systems and processes across sales and finance to support recurring-revenue business models better

The alignment of functions along the revenue cycle

Organizations are aligning their customer-facing revenue teams – and the systems, processes, data, and operations that support them – along the revenue cycle to maximize customer lifetime value and eliminate revenue and margin leakage. 67% of finance executives believe they should better align with sales leadership to improve forecasting and maximize revenue growth.

A revolution in advanced analytics in sales and finance

A revolution in advanced analytics and AI-led innovation – fueled by rich new sales engagement data sources and the broader adoption of selling approaches – have become a primary driver of firm value creation. As a result, over 60% of CFOs are making it a priority to leverage analytics and improve data management to improve visibility and drive insights.

In combination, these dynamics are “breaking the back” of outdated forecasting processes based in silos, built on bookings data, managed on spreadsheets, and driven by the fiscal calendar.

- Nearly two-thirds (65%) of senior financial executives report they are having operational problems establishing processes to track, manage, and maximize revenue over the long term, according to a survey of finance executives from CFO Research and Salesforce.6

- Of the companies launching a recurring revenue product or service, nearly two-thirds (65%) of senior financial executives faced operational problems, according to a survey of senior finance executives by CFO Research.6 The difficulties arose in numerous areas — from not being set up to process, track, and manage recurring revenue to not having the tools to manage and leverage the data produced by subscription sales to not using the metrics that the business model demands.

- It is estimated that 1 to 5% of EBITDA flows unnoticed out of companies because they do not have their contract management and payment follow-up processes entirely in order, according to Nikolaas Vanderlinden, Executive Director Advisory (Risk) at EY.1

The confluence of these trends – and the financial, performance, and timing constraints they impose on finance teams – has forced CEOs and growth leaders to rethink how their teams manage and forecast revenue. Unfortunately, the traditional way most organizations generate forecasts is proving too slow, too labor intensive, and unresponsive to these changing customer dynamics. They are also blind to most post-commitment variables impacting future revenue realization, production needs, and resource allocation decisions. This lack of timely and accurate information in these forecasts makes it nearly impossible for production, sales, and success teams to adjust operationally to gaps in expectations and has real financial consequences:

- Short term, the yield on committed revenue is reduced as CFOs are experiencing a revenue realization gap of up to 50% of expectation due to a lack of operational alignment

- From a downstream perspective, CFOs are unable to provide reliable revenue forecasts to investors, which hurts the share price

- From an upstream perspective, the uncertainty about future revenue leads to over or underutilization of production and selling capacity and lowers the return on assets

Managers need to get faster, more innovative, and more in generating forecasts. That is why Dynamic Forecasting has emerged as a critical need for CEOs, CFOs, and growth leaders. Progressive finance teams are embracing Dynamic Forecasting as a better way to align an organization’s processes and data across the core business groups to make forecasting more agile, transparent, and precise over time. Moving to a more agile, , and reliable revenue approach to forecasting has become necessary for organizations to compete in this new era. To make it a reality, the most progressive business-to-business firms are taking concrete steps to leverage their customer data to automate the forecasting process, create better alignment and collaboration, and create feedback loops between the front and back office

“The notion of operational and financial forecasting and future revenue recognition is a hot issue for everyone right now, given the uncertainty in the macro environment. Especially in industries like manufacturing and professional services where managing capacity, inventory, and fulfillment assets are so critical,” according to Tim Brackney, the President and Chief Operating Officer at RGP (Nasdaq: RGP), a 25-plus-year-old professional services firm helping clients find the right skilled talent needed to tackle change and transformation initiatives.”

What Is Dynamic Forecasting and Why Is It So Important?

The concept of Dynamic Forecasting is to align an organization’s processes and data across the core business groups to make forecasting more agile, transparent, and precise over time. Dynamic Forecasting aligns, operationalizes, and automates the forecasting of revenue. It effectively moves the forecasting process from a calendar-based approach to an “always on” skill set that becomes a day-to-day management tool.

Dynamic Forecasting differs from bookings-based sales forecasting efforts in two ways: it looks at the key activities and outcomes upstream and downstream of the sales transaction. It then links the supply chain to the demand chain to the future revenue estimates that form the basis of firm valuation.

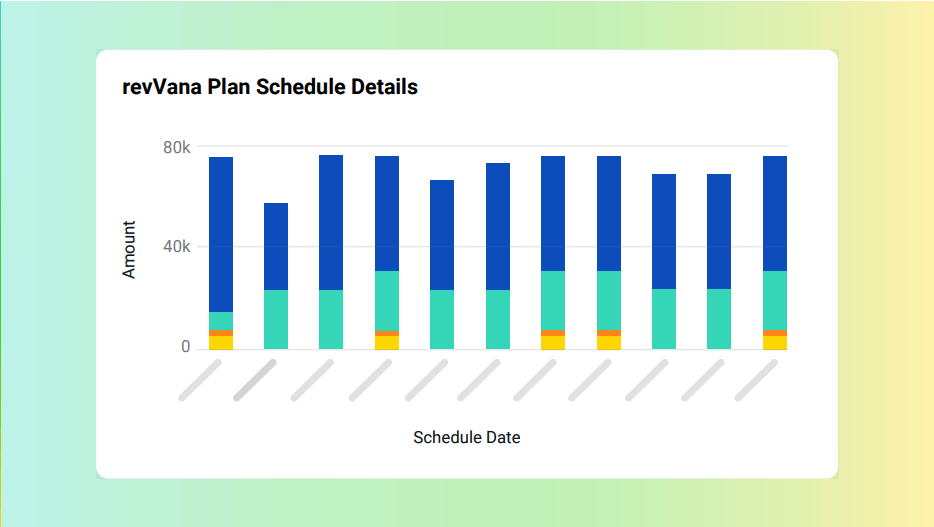

Dynamic Forecasting utilizes existing data, systems, and knowledge from the field and operations teams to expand the inputs and improve the outcomes of existing sales forecasts. It goes beyond commitment size and bookings to factor in the pre-and post-transaction variables, impacting the ramp and finance-based recognition of total expected revenue over time. This approach provides finance with better visibility into changes to the committed business in-flight and the expansion or contraction of existing business on account. It factors in multiple data sources, including pretransaction signals of customer intent and close rates and post-transaction data from customer success, services, product usage, and account management. This helps Revenue Operations and Finance teams create more reliable estimates of how revenue will ramp when realized over time and what “run-rate” revenue will be as customers reach a steady state.

Dynamic Forecasting also significantly improves forecasting outcomes by creating an active feedback loop. This creates better “connective tissue” that links the financial planning and analysis teams, which report revenue to the upstream product, sales, and production teams that generate revenue. The feedback loop starts by automating more granular revenue forecasts and updating them with customer activity and success data to create more timely and precise forecasts. The loop is closed by providing questions, alerts, and plan adjustments to the upstream product, sales, and production teams that expose operational gaps. This helps them take action to eliminate revenue leakage, variances, and shrinkage with better planning, controls, and execution. It also gives leadership teams greater visibility into the production and demand chain operational Operations Supply Chain Demand Chain Planning and Analysis Sales Finance Sourcing Capacity Planning Adjust Backlog Management Anticipate Demand Forecast Reallocate Revenue Bookings Remediate Revenue Ramp Diagnose Run Rate Revenues Production Availability Net New Revenues Run Rate Revenues Feedback Loop Expression Revenues Realize Revenues Forecast Revenues Projected Cash Flow 10 variables. Better response to changes in expectations unlocks more predictable growth from the revenue chain by eliminating the leakage and “slack” built into it to buffer against uncertainties, variances, and inefficiencies inherent to running the business.

“It takes a great deal of diligence and detail to get operational forecasting right. But the costs of not doing it are huge to the business,” says Tim Brackney. “You need to stay close to what is going on in accounts and constantly update your systems with information about potential delays, sequencing, and change orders that can impact revenue recognition, forecasts, and asset allocation. You need to look under a microscope and monitor the detailed logistics of rollout and timing to get a handle on the rollout, ramp, and run rate of a given account. This is essential information we use to run the business. It helps me ‘see cliffs’ and anticipate, explain, and ideally avoid revenue shortfalls or under-utilized assets. It helps me redeploy assets to new projects and adjust my revenue forecasts.”

Dynamic Forecasting makes financial sense because it not only improves the yield on current revenue but also addresses the upstream and downstream financial impacts of unreliable revenue – which are even more severe. For example:

From a demand chain perspective, CFOs are experiencing a revenue realization gap of up to 50% on committed new business because they cannot see or anticipate the variables that impact revenue ramp. This is because as new business ramps up, factors like training, delivery, onboarding, client scheduling, service issues, and user adoption can all dramatically change when revenue are realized and recognized. In addition, most forecasting systems only look at commitments at the time of sale and fail to capture or manage these critical post-transaction operational processes. “Forecasting and recognizing revenue from media contracts is a big issue for the entire industry,” says Vincent O’Toole, CFO at Horizon Media, the largest independent media company that places over $9 billion in media every year. “Generating reliable forecasts is inherently challenging because of the wide variances in media mix, the timing, and sequencing of when media is deployed, and the episodic nature of short-term programs and promotions due to product launches, campaigns, and changing customer demand. This is exacerbated by the bidding process and the on-demand nature of media consumption by customers in digital and OTT formats, which make up a growing share of the media mix. As the largest independent media agency, we’ve gained decades of experience buying billions of dollars of media and working with the industries to develop systems and processes for more precisely managing revenue and reliably forecasting them.”

“We have shifted sales compensation to motivate sales to focus more on the factors that drive revenue recognition like adoption and utilization,” says Scott Kelly, the Senior Vice President of Sales, Customer Success, and Revenue Operations at Global Healthcare Exchange (GHX). “We moved from 100% of bookings to compensate sales to 70%. When we pay our reps, we are leaving 50% of bookings out of u -front commissions until we understand the ramp, run rate, and account dynamics of those accounts. So, we currently estimate the yield as 50% of full expected value upon commitment and 50% after 12 months when we have a better handle on ramp and run rate. As our forecasting becomes more and precise, we will be able to shift those numbers.”

From a downstream perspective, the firm’s value is diminished because CFOs cannot provide timely and accurate revenue forecasts to the business or investors. This inability to create reliable forecasts makes it hard for CFOs to communicate future revenue to investors accurately. When earnings “miss” consistently and investors lose confidence in future revenue, it can cause a material impact on firm value and share prices. Commonly used sales-driven metrics such as Annual Recurring Revenue (ARR) and Total Contract Value (TCV) are based mainly on “bookings.” These commitments fail to factor in changes in demand, usage, consumption, rollout schedules, and delivery failures that can impact accuracy. Without better information on client actions deeper in the revenue cycle – from customer success, customer service, and account management teams at the front lines – CFOs and CROs are flying blind.

“It’s important to plan past the commitment transaction if you want to realize, retain, and expand the revenue you book in sales because things change after the contractual commitment,” says Michelle Sidwell, VP of Enterprise Sales at SalesLoft. “Client priorities change. Schedules change. The market changes and things can go wrong. So we view the booking as the start of a two-way relationship with a client in an enterprise sale. Our sellers work hard with the client to determine what we both need to do for the relationship to work and for the expected revenue to be realized – what we do, what the client does, and how it will work specifically.”

From an upstream perspective, all executive leadership must be mindful of the impact of these booking estimates on company resources. For example, most sales forecasts focus on new business in a given quarter and do not consider the time delay of the first transaction or the ramp-up that often occurs to produce revenue. This makes it more challenging to use this data reliably when allocating production, other capacity, or even the supply chain to deliver the revenue-generating value in the new contracts. A more significant challenge is predicting ongoing revenue from existing relationships which is often not formally forecast, as they also impact demand and other capacity planning.

Why Is It So Difficult to Forecast Revenue in a Modern Commercial Model?

“Revenue recognition has emerged as one of the more challenging audit issues because of the growing complexity of contracts, the nuances of client acceptance of delivery in a software-as-a-service (SaaS) world, and the pace of change in business,” according to Scott Gehsmann, who serves on the board of partners at PwC, the world’s second-largest accounting firm. “The challenge of ensuring yourrevenue forecasts don’t get out in front of your actual revenue is amplified when the economy contracts, creating bigger headaches.”

The root of the problem is that the revenue object – a contract or booking – has to be handed off from the sales organization to accountants who recognize and record the information in their accounting and financial management systems. At the start, sales will own the contract before it is executed. In the middle, the goods or services need to be accepted by the client based on things being delivered and aspects of projects being completed. That’s where the gray area comes in. Many things can change in the “messy middle” between the time a contract is written, and the customer’s performance obligations are met and accepted. Users can get laid off, deliveries can be delayed, and timetables can get stretched out.

Historically, the Financial Planning and Analysis (FP&A) teams bridged this gap to help apply rules and run down any delays, scheduling slips, or contract amendments to ensure accounting had the most accurate information to put into the financial accounting system (ERP). But the process is largely manual and slow. As a result, the best organizations have created formalized feedback loops where they can adjust their forecasts to reflect changes in the client’s budgets, delays, or contract adjustments every month.

“This principle had its origins with large construction and manufacturing contracts, where the company was paid when they hit pre-defined milestones of progress agreed to and accepted by the client,” Gehsmann continues. “Things got away from the accounting industry when the software, biotechnology, and services industry – like MicroStrategy and GE – started getting aggressive with how they recognized and realized revenue. From a policy perspective, the ASC606 accounting standards for revenue recognition have helped accountants to regain control somewhat but bridging sales and finance systems with stakeholders and data is only getting more challenging.”

60% of FP&A organizations are driving global ownership of end-to-end processes by reducing process fragmentation and standardizing and harmonizing operations, according to a survey of 300 global CFOs and their direct reports by the Everest Group in 2022.11

“There are several internal and external variables impacting revenue recognition, realization, and forecasting,” according to Scott Kelley, the Senior Vice President of Sales, Customer Success, and Revenue Operations at Global Healthcare Exchange (GHX). GHX is a privately held SaaS company that’s helping reduce the cost of delivering care by automating key business processes to improve decision-making and improve patient outcomes.

GHX has two revenue streams, both of which are impacted by post-booking variables, though one more than the other.

Most of GHX’s revenue is from SaaS streams associated with the GHX Exchange Enterprise, which helps automate and enhance the entire procure-to-pay process. While these revenues are contracted over 3-5 years with annual billing, they are relatively predictable because Kelly’s team can get a 95% renewal rate and a flat fee for services.

The bigger problem is with the payment product – GHX ePay Solution – which is priced using a consumption-based model, like a credit card. This represents an alternative set of “payment rails” for patients to make payments (vs. direct bill, ACH check, and credit card). Dynamic Forecasting is a far more significant issue here. Revenue recognition for this consumption-based offering is confounded by at least half a dozen post-booking variables that occur after the deal is closed. For example, the revenue ramp has slowed dramatically. The customer set-up process has gotten much slower due to COVID-19, so the “go live” date is happening later. It used to be 45-60 days after the booking, but now there are enormous delays in onboarding because of resource, training, and labor shortages. As a result, it can take as long as seven months for the system to go live and start earning revenue.

Capacity hurts in other ways too. For example, all hospitals have labor shortages, and they need that workforce to provide services and to bill. This shows up in a revenue forecast.

Adoption is another issue making the forecast challenging. This is because the number of customers the health care provider chooses to put in the system and the volume of payments vary. Not every vendor or patient of a given healthcare customer is in the system, so selling must be an everyday activity, and upselling is variable across accounts.

The downturn in the external economy has had a significant impact on revenue forecasts. Run rate payments in 2022 are not a good predictor of 2023 because of the post-covid slowdown in healthcare consumption. Also, as people lose jobs, they lose health care and have access to fewer services.

Figure 3: 24 post-booking variables that impact revenue realization

About the Research

This ongoing research initiative is led by the expert faculty of the Revenue Enablement Institute in collaboration with industry practitioners and experts in the field of sales, marketing, and the emerging role of Dynamic Forecasting to help CEOs, CFOs, CXOs, and operations executives develop a faster, smarter, and more approach to generating growth plans and forecasts.

The authors of this composite analysis include:

Stephen Diorio is the Managing Director of the Revenue Enablement Institute and a Senior Fellow at the Wharton Customer Analytics Initiative. A leading authority in go-to-market transformation, sales and marketing performance management, and revenue operations, Stephen has helped over 100 organizations to reengineer their revenue operations to accelerate growth and become more datadriven, digital, and accountable. He has authored several books on commercial transformation including Revenue Operations: A New Way to Align Sales & Marketing, Monetize Data (Wiley, 2022) and Beyond e: 12 Ways Technology is Transforming Sales and Marketing Strategy (McGraw Hill, 2002).

Stephen Diorio is the Managing Director of the Revenue Enablement Institute and a Senior Fellow at the Wharton Customer Analytics Initiative. A leading authority in go-to-market transformation, sales and marketing performance management, and revenue operations, Stephen has helped over 100 organizations to reengineer their revenue operations to accelerate growth and become more datadriven, digital, and accountable. He has authored several books on commercial transformation including Revenue Operations: A New Way to Align Sales & Marketing, Monetize Data (Wiley, 2022) and Beyond e: 12 Ways Technology is Transforming Sales and Marketing Strategy (McGraw Hill, 2002).

Chris Hummel is a Managing Director at the Revenue Enablement Institute leading CXO programs and the President of Green Thread. Chris is a global CXO with a track record of accelerating revenue and adapting to changes in the buying and selling environment. He has successfully led sales, marketing and product teams at worldclass companies like Oracle, SAP, Schneider Electric, Siemens and United Rentals. Learn more about his successes aligning sales and marketing; collaboratively creating digital products and services; and using brand repositioning to amplify business strategy to drive measurable and scalable growth. Chris is the co-author of the book Revenue Operations: A New Way to Align Sales & Marketing, Monetize Data (Wiley, 2022)

Chris Hummel is a Managing Director at the Revenue Enablement Institute leading CXO programs and the President of Green Thread. Chris is a global CXO with a track record of accelerating revenue and adapting to changes in the buying and selling environment. He has successfully led sales, marketing and product teams at worldclass companies like Oracle, SAP, Schneider Electric, Siemens and United Rentals. Learn more about his successes aligning sales and marketing; collaboratively creating digital products and services; and using brand repositioning to amplify business strategy to drive measurable and scalable growth. Chris is the co-author of the book Revenue Operations: A New Way to Align Sales & Marketing, Monetize Data (Wiley, 2022)

Citations

3. Grant Thornton, As Conditions Get Tough, CFOs Get Tougher, Grant Thornton 2Q22 CFO survey of 249 CFOs, 2022. Available at:2022-CFO-Survey-Q2-Executive-Summary.pdf The

6. CFO Series: Challenges in Adapting to Recurring-Revenue Business Models, survey of finance executives by Salesforce and CFO Research, 2019. Available at: https://cdn-cf.cfo.com/content/uploads/edd/2019/03/CFO_ Salesforce_eBook_2019.pdf

7. Deloitte, Dynamic Finance: Transforming Finance from Function to Dynamic Capability, 2022. Available at: https:// www2.deloitte.com/us/en/pages/finance-transformation/articles/crunch-time-dynamic-finance.html

9. Association of International CPA’s, AICPA Business and Industry Economic Outlook Survey, survey of 511 AICPA members, 2022. Available at: https://www.aicpa.org/professional-insights/download/4q2022-aicpa-business-andindustry-economic-outlook-survey

11. Everest Group, The Global CFO Survey 2022: Separating Chatter from Reality, Global survey of 300 CFOs and direct reports, 2022. Available at: WNS_Everest_Global_CFO_Survey_2022_Report.pdf

13. Nito, Grace, CFOs up forecasting frequency amid economic uncertainty, CFO Dive, 2022. Available at: https://www. cfodive.com/news/cfos-up-forecasting-frequency-recession-risk-looms-survey-aicpa-cima/637784/

Ready to dive deeper?

Dynamic Forecasting Report

Published on Friday, August 4, 2023