For advertising companies, achieving precision in revenue forecasts is a vital component of strategic decision-making. However, the complexity of data and the need for real-time revenue insights pose significant challenges, especially for finance leaders tasked with ensuring the company’s financial health and growth. Data silos that exist across departments make this even more challenging. This guide will explore how cross-departmental collaborations can significantly enhance forecast accuracy and operational efficiency.

In this guide, you’ll learn:

- The importance of cross-departmental data sharing for accurate forecasting.

- Strategies to align interdepartmental data for better revenue predictions.

- How real-time CRM to Finance data alignment influences financial outcomes.

- Best practices for optimizing forecast accuracy in complex revenue models.

The Critical Role of Cross-Departmental Insights

For CROs, CFOs, and FP&A leaders, the accuracy of revenue forecasts directly correlates with a company’s ability to strategize and grow. When departments such as sales, marketing, and operations effectively share and align their data, the finance team can synthesize this information to produce more accurate and actionable revenue forecasts.

Enhancing Forecast Accuracy Through Sales and Finance Data Alignment

Real-time Data Access:

Integrating real-time data from different departments is crucial. For instance, insights into sales performance or feedback from customer success help finance professionals adjust forecasts to reflect the current business environment accurately. The best way to do this is to incorporate CRM and other customer sentiment data with your Financial forecasting processes. Customer platforms like Salesforce also allow you to implement third-party tools to enhance your forecasting, tools such as revVana.

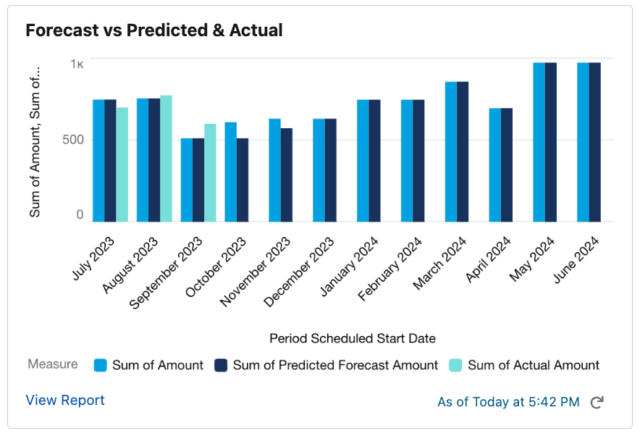

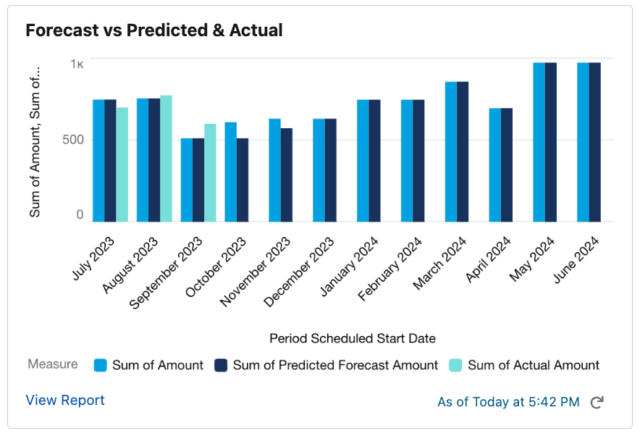

Alignment of Forecasts and Predictions with Actuals:

Regularly comparing forecasted figures with actual outcomes is essential for understanding discrepancies and refining forecasting models. This alignment helps in identifying trends that may not be visible when each department operates in a silo. Comparing forecasts vs actuals inside of your CRM also provides the most up-to-date information to ensure forecast accuracy.

Strategies for Effective Revenue Forecasting

Forecast the entire revenue lifecycle:

Define models to forecast the financial and operational impact of your full customer revenue life cycle. This includes translating pipeline into revenue, forecasting impressions, and other advertising-specific operational metrics. Aligning forecasts from the pipeline through revenue execution after closing the deal will reduce inconsistencies and enhance forecast reliability for the organization.

Regular Cross-Departmental Meeting Cadence:

Hold regular meetings involving key stakeholders from all departments to discuss the data needs and forecasting objectives. It is not common for sales and finance to forecast daily and weekly, however, it’s important to bring those forecasts together on a monthly or quarterly basis. By coordinating forecasting cadence across departments, organizations can ensure everyone understands how their contributions affect the company’s financial forecasts and goals.

Best Practices to Optimize Forecast Accuracy

Leverage Analytics:

Utilize tools that offer advanced analytics to identify opportunities and gaps. Leverage machine learning and AI to identify patterns that humans may overlook. However, be sure you have the ability to provide the data for these platforms. It’s important for these tools to integrate sales and finance data. Minimizing manual forecasting processes in Excel or other customized solutions is also beneficial For Salesforce users, revVana is a forecasting tool that helps advertising companies generate and maintain this data.

Align Sales, Operations, and Financial Forecast Timing:

Aligning the frequency of Sales, Operations, and Finance forecasting is also key. Financial forecasts based on stale Sales data are not beneficial. Leverage automation to remove delays in data preparation. Frequent forecasting allows for quick adjustments and improves the overall agility of the organization as a whole.

Train Teams on Data Importance:

Educate all team members on the importance of data accuracy and timeliness in their reporting, ensuring they understand how their data contributes to larger forecasting goals and company success

Frequently Asked Questions

How often should we update our forecasts?

It’s advisable to update forecasts at least monthly or as major changes occur within the pipeline and customer activity, which could be daily. The more frequently you can update and adjust your forecasts based on real-time data, the better.

Can we rely solely on AI and Machine Learning for our forecasting needs?

While AI offers significant advantages in processing large volumes of data and identifying trends, human oversight is crucial for addressing anomalies and applying contextual business understanding. Continual comparisons of automated and machine-generated forecasts with sentiment from customer-facing teams help improve forecast models.

What are the first steps toward improving our interdepartmental data sharing?

Begin by setting clear objectives for what you wish to achieve with improved data sharing with key stakeholders of each department. Then identify opportunities to align data and timing across these functions.

By embracing these strategies and fostering an environment where cross-departmental collaboration is the norm, finance leaders in advertising companies can greatly enhance their forecast accuracy, providing a robust foundation for strategic decisions that drive growth. As technology evolves, the ability to quickly adapt and refine forecasting models will continue to be a competitive advantage, encouraging a culture of innovation and forward-thinking. For Salesforce customers, AppExchange tools such as revVana are invaluable in providing real-time forecast automation and help you accomplish these goals.