Forecasting revenue is hard enough when deals close in neat, recurring contracts. But for companies selling consumption-based products, the challenge multiplies. Usage fluctuates, customer behavior shifts, and even small changes in adoption can swing revenue significantly from quarter to quarter.

If you’re trying to forecast usage-based revenue inside Salesforce, you’ve probably noticed the cracks: native tools weren’t built to handle these dynamic patterns. That’s where specialized approaches (and tools like revVana) come in.

In this article, we’ll break down what consumption-based forecasting is, why Salesforce alone falls short, and how to implement best practices that make your forecasts reliable and actionable.

What Is Consumption-Based Forecasting?

Unlike subscription or project-based models, consumption-based forecasting focuses on predicting how much of a service customers will actually use, whether that’s API calls, kilowatt hours, ad impressions, or any other measurable unit.

The difficulty is that usage can spike or dip unexpectedly. A customer may start small and scale rapidly, or they might churn halfway through the year. Good forecasting models need to account for seasonality, adoption curves, and external factors that traditional “closed-won” forecasts ignore.

Why Salesforce Alone Falls Short

Salesforce is a powerful CRM, but when it comes to usage-based revenue forecasting, it wasn’t designed for the task. Here are a few common limitations:

- Static pipeline focus: Standard Salesforce forecasting emphasizes opportunity stages and close probabilities, not variable usage after the deal closes.

- Manual workarounds: Many teams try to track usage with spreadsheets or custom fields, leading to errors and data silos.

- Lack of predictive depth: Native tools don’t model adoption rates, seasonality, or historical usage patterns — all critical for consumption forecasting.

These gaps create blind spots in forecasting accuracy, which can cascade into missed revenue targets or underinvestment in key growth areas.

Best Practices for Consumption Forecasting in Salesforce

To get accurate, dynamic forecasts inside Salesforce, here are proven practices to follow:

- Integrate Actual Usage Data: Pull customer usage metrics directly into Salesforce from billing systems, product telemetry, or data warehouses. This ensures forecasts are tied to reality, not assumptions.

- Apply Forecast Patterns: Use models that replicate real-world adoption patterns — ramp-ups, seasonality, or tapering usage. Tools like revVana allow you to apply statistical and AI-driven patterns automatically.

- Forecast Beyond the Deal: Don’t stop at closed-won. Extend forecasts into the contract lifecycle, projecting renewals, expansions, and consumption variability.

- Automate Updates: Replace manual spreadsheets with automated processes. Real-time syncing between Salesforce and your forecasting engine reduces errors and speeds up insights.

- Layer AI/ML Models: Statistical methods are useful, but machine learning models that adapt to shifting patterns can significantly improve forecast accuracy over time.

Common Pitfalls to Avoid

Even advanced teams stumble on a few predictable mistakes:

- Relying only on historical averages: Past usage is valuable, but without modeling adoption shifts, forecasts remain shallow.

- Treating all customers the same: Segment customers by product type, deal size, or industry to reflect different consumption behaviors.

- Overcomplicating the model: Forecasts must be explainable and usable by finance, RevOps, and sales, not just data scientists.

- Ignoring external signals: Market conditions, customer launches, or pricing changes often have as much impact as raw usage data.

How revVana Helps

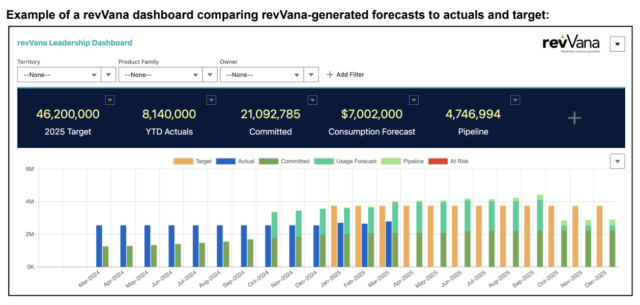

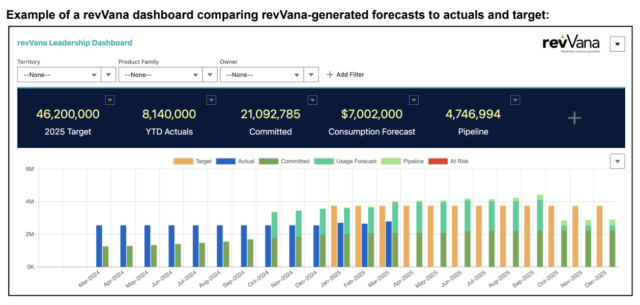

revVana fills the gap between Salesforce and advanced forecasting needs. By applying forecast patterns, statistical models, and AI-driven insights directly inside Salesforce, teams can:

- Forecast usage with real-time data integration.

- Automate updates across the pipeline and customer lifecycle.

- Build forecasts that finance and sales can trust — without leaving Salesforce.

The result is more accurate, dynamic forecasting that aligns with your actual revenue model, not just static pipeline probabilities.