Salesforce Forecasting: Build a Revenue Forecasting Machine

Last updated on Sunday, April 3, 2022

Sales forecasting is an essential process for businesses, as it helps organizations anticipate future sales and make informed decisions based on these estimates. Accurate sales forecasting can lead to better resource allocation, inventory management, and financial planning.

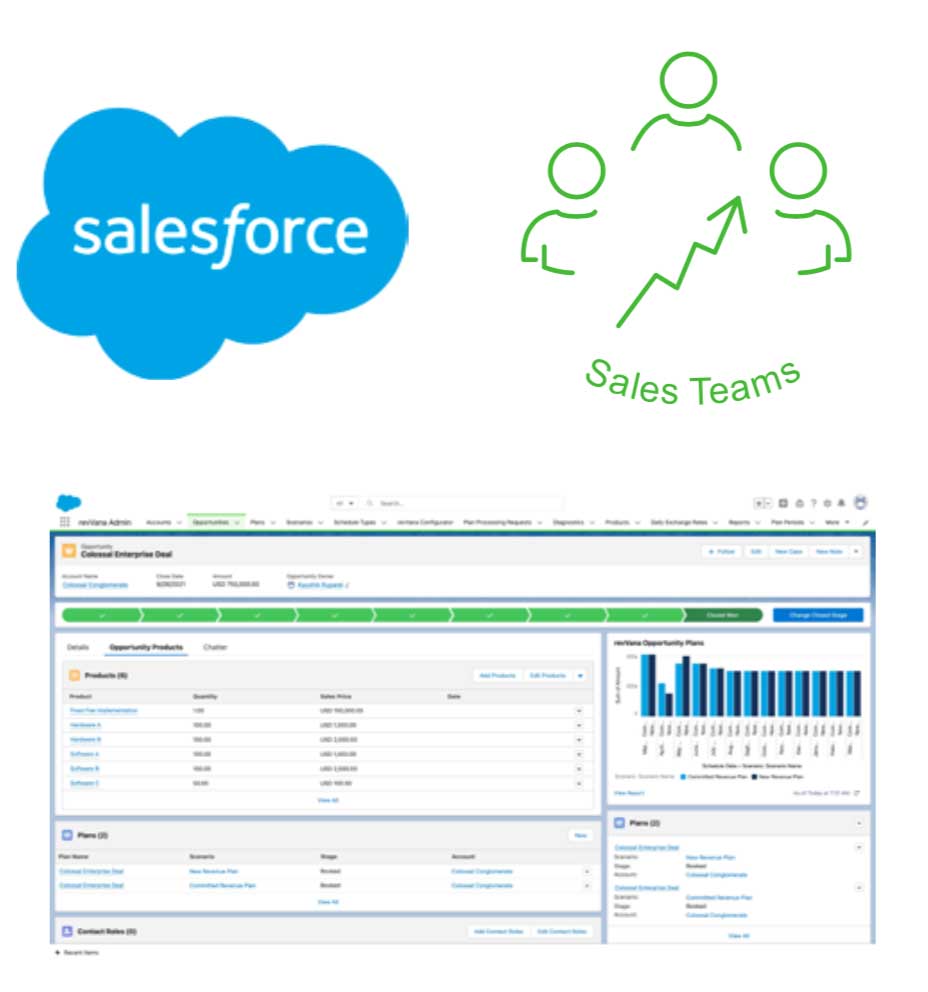

Salesforce, a leading customer relationship management (CRM) platform, has become a go-to solution for sales teams to streamline and enhance their sales operations. With its robust sales forecasting capabilities, Salesforce empowers businesses to create accurate, revenue forecasts and drive growth.

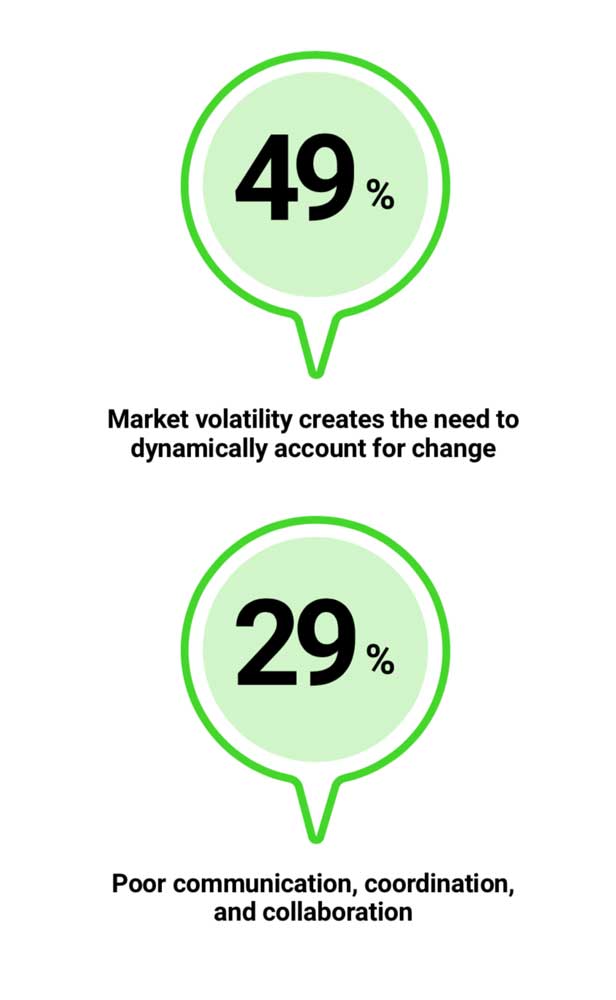

However, when it comes to revenue forecasting, particularly for companies with revenue from bookings or subscriptions, there are challenges that need to be addressed to fully harness the potential of revenue forecasting in Salesforce.

Why Salesforce is a Powerful Tool for Sales Teams

Salesforce has established itself as a powerful tool for sales teams due to its extensive CRM capabilities and the AppExchange market, which offers numerous solutions to extend its functionality. These features contribute to the platform’s effectiveness in salesforce forecasting by allowing businesses to manage both existing clients and potential leads, track customer behavior, and create targeted sales strategies.

The platform’s salesforce forecasting capabilities enable sales teams to predict both short-term and long-term performance, which is crucial for making informed business decisions that benefit the entire organization. By leveraging Salesforce’s robust forecasting tools, businesses can establish team quotas, continuously track sales progress, and work towards achieving their company goals.

However, companies with revenue coming in over time, such as through bookings or subscriptions, may encounter challenges when trying to extract accurate insights from Salesforce for financial planning and analysis. This is where teams need to find ways to automate revenue forecasting and reduce manual errors, ultimately leading to smarter, decisions.

Sales Forecasting in Salesforce

Salesforce allows for customizable forecasting, in which users can create custom fields, change their forecast settings, or customize forecast categories as needed. The native Salesforce Sales Cloud forecasts page highlights forecast amounts based on the totals and subtotal of the above opportunity stages.

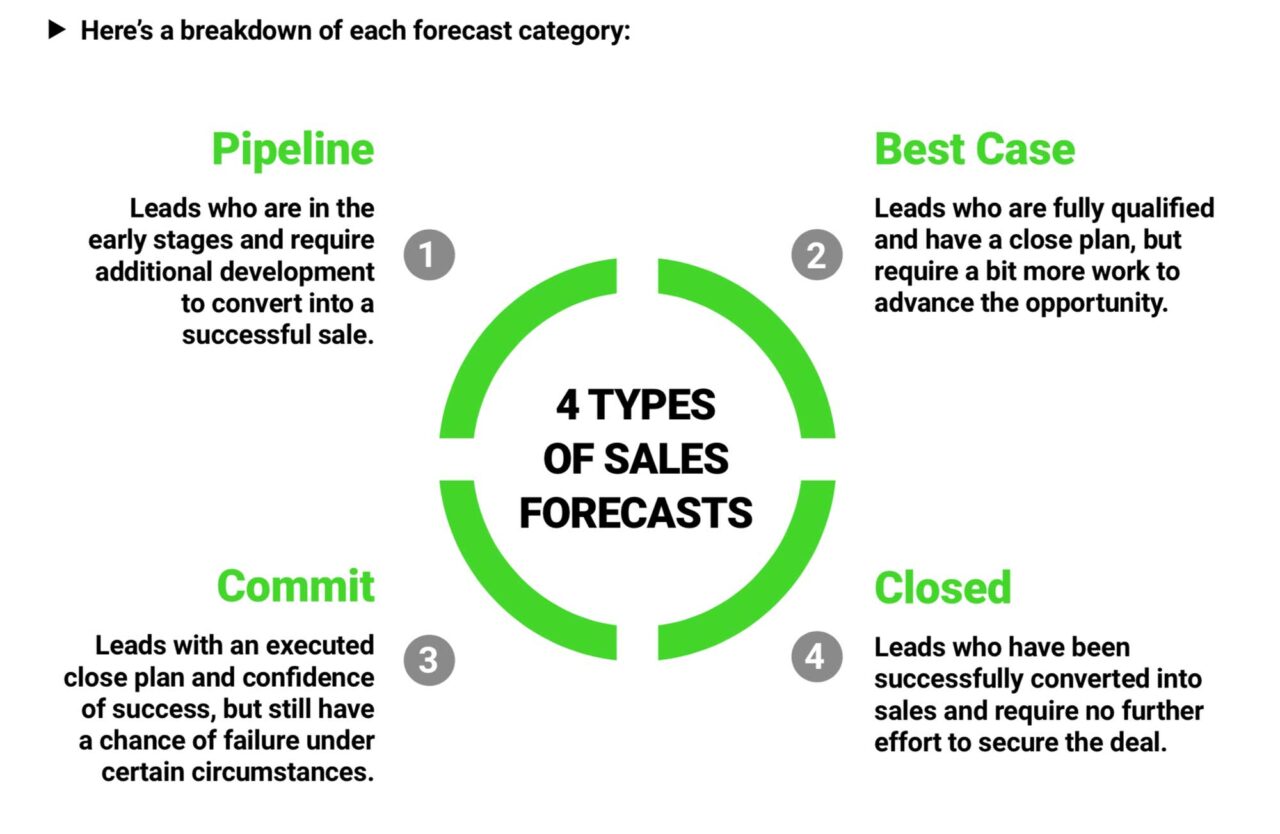

Salesforce’s forecast categories are used to classify the type of sales opportunity based on a sales team’s level of confidence that they successfully land the sale. In addition, typical forecast categories in Salesforce include:

- Pipeline (sales opportunities that are expected to close in the future).

- Best Case (sales opportunities that are expected to close with the highest possible value).

- Commit (sales opportunities that are expected to close within a specific period).

- Closed (sales opportunities that have already been closed and won).

Customizable forecasting and forecast categories in Salesforce help sales teams create more accurate revenue forecasts and plan effectively for the future.

Revenue Forecasting in Salesforce

While Salesforce’s sales forecasting tool is useful for estimating future sales revenue, it has limitations when it comes to revenue forecasting. Revenue forecasting in Salesforce is often done through error-prone and time-consuming spreadsheets, leaving a gap in the value of the software investment. This can lead to revenue visibility issues for financial planning and analysis and sales operations teams.

Manual creation of revenue forecasts and reports is also prone to human error, which can impact the accuracy of revenue forecasts. This is where a cloud-based integration like revVana Salesforce Revenue Forecasting can help. By translating forecasts in the pipeline and closed opportunities into revenue streams, revVana automates and streamlines revenue forecasting, providing real-time insights on CRM data and reducing manual errors.

Enhancing Revenue Forecasting in Salesforce with revVana

revVana is a cloud-based integration that can help organizations enhance their revenue forecasting in Salesforce. With revVana, organizations can instantly translate forecasts in the pipeline and closed opportunities into forecasts of revenue streams. This helps organizations make smarter, decisions and stay ahead of the competition.

revVana offers a range of benefits, including:

- Automating and streamlining revenue forecasting in Salesforce.

- Providing real-time insights on CRM data.

- Reducing manual errors and increasing accuracy.

- Aligning sales and finance teams to achieve common revenue goals.

Expanding the Value of Salesforce for the Entire Organization

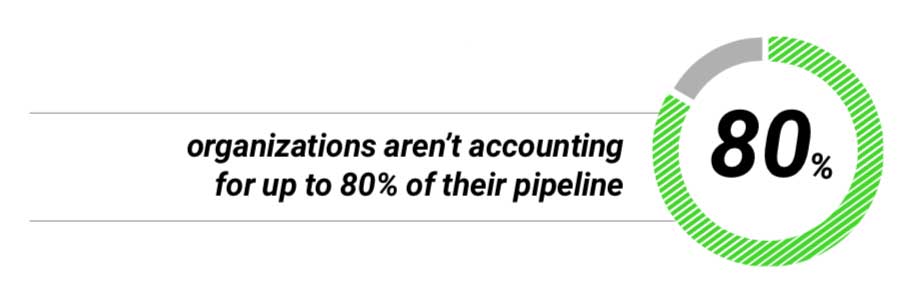

Salesforce is a powerful tool not just for sales teams but for the entire organization. However, for many organizations, Salesforce is typically not leveraged for revenue visibility and forecasting beyond its capabilities. This can result in revenue visibility issues for financial planning and analysis (FP&A) and sales operations teams.

To expand the value of your CRM for the entire organization, it is essential to incorporate Salesforce revenue forecasting tools. This can help organizations achieve common revenue goals and enable cross-functional use of Salesforce. By aligning Salesforce with revenue forecasting tools, such as revVana, sales and finance teams can work together more effectively to create more accurate revenue forecasts and plan effectively for the future.

4 Ways to Extract More Value From Salesforce

There are four ways to extract more value from Salesforce when it comes to revenue forecasting.

1. Align Salesforce With the Revenue Forecasting Process

Sales and finance teams are often siloed, which can result in revenue visibility issues for financial planning and analysis and sales operations teams. To avoid this, it is essential to align Salesforce with the revenue forecasting process. This can help organizations achieve common revenue goals and enable cross-functional use of Salesforce.

2. Identify Revenue in the Pipeline Through Automation

Salesforce’s sales forecasting tool can help organizations identify deals that are expected to close in the future. However, to get a complete picture of revenue streams, organizations need to identify revenue in the pipeline. This can be done through automation, which can help organizations anticipate changes and see what revenue looks like over time.

3. Track Revenue Changes Inside Salesforce

Deals in Salesforce are subject to change, and tracking these changes can be challenging, especially when done manually. By tracking revenue changes inside Salesforce, organizations can avoid revenue visibility issues and make more informed business decisions.

4. Give the Sales Teams More Visibility to Revenue in Salesforce

Sales and finance teams have different requirements when it comes to viewing sales data. However, the silo walls between these teams can prevent feedback loops, resulting in revenue visibility issues. By giving sales teams more visibility to revenue in Salesforce, they can make more informed sales decisions that align with the organization’s revenue goals.

You Can Enhance Your Revenue Forecasting in Salesforce

Are you tired of inaccurate revenue forecasts costing your company millions of dollars? Don’t let manual processes and human error stand in the way of your organization’s success. Take action today to enhance your revenue forecasting in Salesforce and make smarter, decisions that will help you stay ahead of the competition.

revVana can help your organization achieve these goals by automating and streamlining revenue forecasting in Salesforce, providing real-time insights on CRM data, and reducing manual errors. With revVana, you can instantly translate forecasts in the pipeline and closed opportunities into forecasts of revenue streams. This will help you make more informed business decisions and stay ahead of the competition.

Don’t wait any longer to take action – contact revVana today to learn more about how we can help you enhance your Salesforce revenue forecasting capabilities and achieve your revenue goals. Our team of experts will work with you to create a customized solution that fits your unique needs and helps you achieve success. Take the first step towards accurate revenue forecasting in Salesforce with RevVana today.

Ready to dive deeper?

Salesforce Forecasting: Build a Revenue Forecasting Machine

Published on Sunday, April 3, 2022