Managing and forecasting variable revenue streams is a daunting task for any industry, but it’s particularly complex in media and advertising. Companies are expected to quickly digest overwhelming amounts of data and deliver actionable insights to customers in a secure and efficient manner, yet most are still relying on spreadsheets or home-grown solutions to do the work. This results in widespread organizational frustration, security risks, and lack of compliance when it comes time for an audit.

This article outlines::

- The importance of clarity in agreements.

- Strategies to enhance compliance and understanding in these agreements.

- Best practices for implementing robust data management frameworks.

- How compliance supports operational and revenue forecasting accuracy.

- Mitigating risks associated with data sharing and handling.

Simplifying Data-Sharing Agreements

One of the first steps in enhancing compliance and understanding in data sharing agreements is to communicate clearly and effectively. Complex legal jargon can be a significant barrier to understanding, leading to compliance risks and misinterpretation. Simplifying the language and clearly defining terms, obligations, and expectations in your agreements not only fosters better understanding but also ensures that all parties are on the same page.

Establish Comprehensive Governance Frameworks

Implementing a robust governance framework for data management is crucial. This framework should outline who has access to the data, under what circumstances, and the protocols for data usage. It’s important to use a secure system, such as Salesforce, with advanced data-sharing rules that are easily customizable.

Transparency in these frameworks supports accountability and ensures compliance, while also streamlining processes. This, in turn, enhances operational forecasts and strategic alignment across departments, crucial areas of focus for today’s COOs.

CRM’s are often the best area to store data due to their extensive security measures. Often, people pull proprietary financial data outside of their CRM to store in spreadsheets and share via email. This is one of the leading communication methods, yet one of the least secure. Ideally, most financial data and forecasting should be kept inside of your CRM – revVana is a platform that allows you to do just that inside of Salesforce.

Regular Audits and Compliance Checks

Conducting regular audits and compliance checks is essential to ensure all data handling practices conform to agreed terms and legal standards. It’s important to analyze all mediums of data transfer, including CRMs, spreadsheets, and email communications when performing audits. These audits help identify any gaps in compliance and allow for timely remediations. Such proactive measures not only protect the organization from legal repercussions but also reinforce the integrity of data management practices, ensuring that forecasting and strategic planning are always based on accurate and compliant data.

Training and Continuous Education

Ongoing training and education programs for all stakeholders involved in data management and usage can significantly enhance understanding and compliance. These programs should focus on the importance of compliance in agreements and the broader impact of non-compliance on the organization’s operational and financial health. By empowering employees with knowledge and skills, businesses can foster a compliance-first culture that aligns with organizational goals.

Leveraging Technology for Compliance Enhancement

Investing in innovative technological solutions can play a transformative role in enhancing compliance and understanding of data sharing agreements. Tools that automate data compliance checks, such as revVana, ensure secure data storage and transfer, and provide real-time access to compliance reports can drastically reduce the risk of non-compliance. Furthermore, integrating technology like AI to monitor and analyze data handling practices can provide insights that lead to continuous improvement in data management strategies.

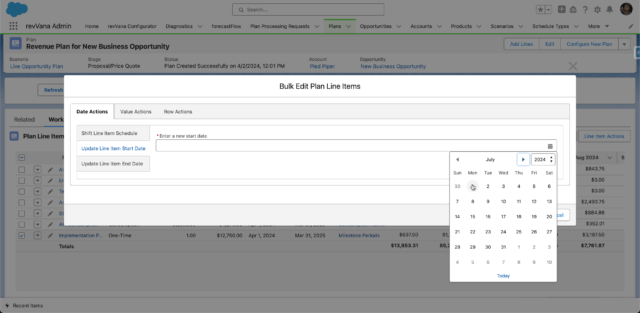

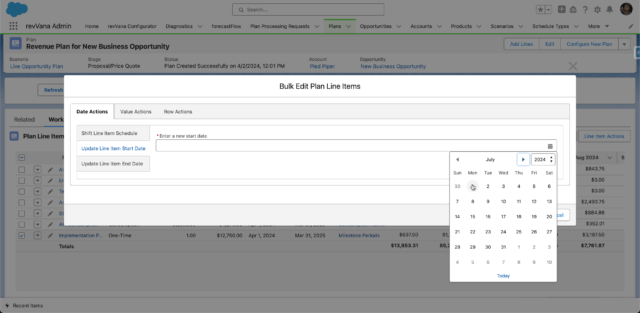

Full profile & user based permissions to control read-only & edit-access. Allow users to make in-line edits or bulk edit actions.

Frequently Asked Questions

1. What are the main benefits of enhancing compliance in agreements?

Enhancing compliance not only minimizes legal risks but also improves the reliability of data analytics, which is crucial for accurate forecasting and strategic decision-making in media and advertising.

Compliance is essential for ensuring your organization’s security. Protecting proprietary financial information from leaking outside your internal database is crucial to maintain client trust and prevent competitors from gaining sensitive insights. Certain tools, such as Salesforce, utilize the most advanced technology for internet security.

2. How frequently should compliance audits be conducted?

The frequency of audits can vary based on the scale of data operations and the sensitivity of the data handled. However, establishing a regular audit schedule, such as bi-annually or annually, is advisable.

3. Can simplifying the language in agreements compromise legal robustness?

Simplifying language does not mean eliminating necessary legal terms or diluting obligations. Instead, it focuses on clearer communication, ensuring that legal terms are understood by all parties, thus enhancing compliance.

4. What role does technology play in managing data compliance?

Technology enhances data compliance by automating processes, securing data transfers, providing real-time compliance status, and facilitating swift corrective actions in case of deviations.

As businesses in media and advertising continue to navigate the complexities of large-scale data management, understanding and enhancing compliance in data sharing agreements is not just a regulatory necessity but a strategic imperative. By adopting these strategies, companies can mitigate risks, enhance operational efficiencies, and drive sustainable growth.

To learn how to better secure your forecasting data and bring revenue forecasting directly inside of Salesforce, book a call with us today.