Revenue forecasting is the lifeblood of every organization because it drives key decisions around capital budgets, hiring, and resource allocation based on accurate revenue projections. True revenue forecasting requires not only understanding what’s in the pipeline but also whether revenue is being recognized and realized post-closed won—especially for revenue models based on consumption or usage.

Many organizations, however, focus too narrowly on pipeline propensity to close when creating forecasts, leading to a limited understanding of their full revenue potential. While tools like Clari and Gong have significantly improved sales enablement by helping to predict deal closures, revenue forecasting needs to evolve beyond just that. It should encompass a comprehensive approach that enhances pipeline intelligence and accommodates the complexities of modern revenue models, ensuring that companies have a complete and accurate view of their revenue streams.

This guide outlines best practices for advancing beyond the traditional focus on propensity to close, discussing why deeper pipeline intelligence and forecasting accuracy are critical for businesses today.

Understanding Propensity to Close

Propensity to close is a great example of where automation has improved pipeline health by leveraging historical and behavioral data. RevOps platforms excel in this area, using advanced analytics to predict deal closures. However, this is only a fraction of what true revenue forecasting encompasses. When businesses focus solely on propensity to close, they miss critical insights that are essential for long-term revenue accuracy.

While AI-powered solutions can increase forecast precision, relying only on propensity to close overlooks how revenue materializes after a deal is won. For example, in complex revenue models like SaaS, where renewal cycles, usage-based billing, and expansion opportunities are key drivers of growth, focusing purely on deal closure probability can lead to missed revenue opportunities. True revenue forecasting needs to account for variables such as customer churn and recurring revenue, ensuring that businesses have a more complete and actionable understanding of their future financial health.

Expanding Pipeline Intelligence

Pipeline intelligence goes beyond deal closure probability. It encompasses a more comprehensive set of metrics and analytics designed to give businesses a full understanding of the health and dynamics of their sales pipeline. This includes tracking deal velocity, win rates, the size and composition of the pipeline, and forecasting shifts in revenue flow over time.

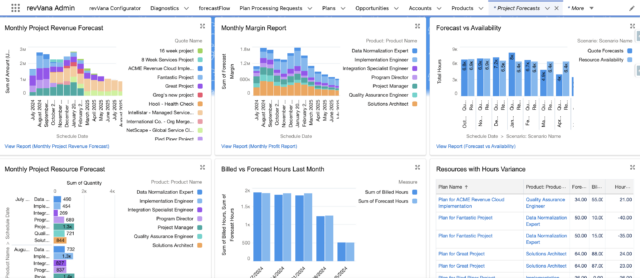

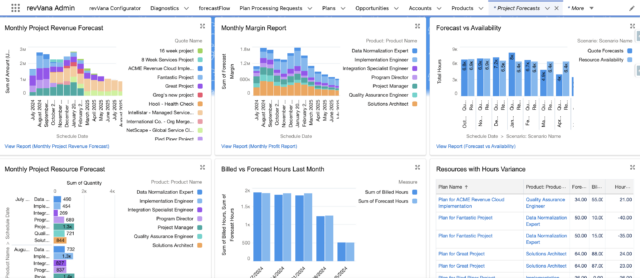

revVana’s Salesforce-Native platform improves pipeline intelligence by using high-quality opportunity data to create more accurate long-term revenue forecasts in Salesforce. By better understanding which opportunities are most likely to close and the potential revenue outcomes, revVana enables companies to align resources strategically, ensuring that their forecasting is both precise and actionable.

Forecasting Complex Revenue Models

Companies with complex revenue models, such as subscription-based or usage-based billing, require more than traditional sales forecasts. revVana provides an in-depth look at the “revenue shape” of deals, incorporating not just closure probability but also forecasting revenue after the deal closes, including renewals, expansions, and consumption rates.

Understanding what’s going up or down in your pipeline helps organizations manage revenue more effectively. By offering real-time forecasting updates and better clarity on pipeline health, revVana enables companies to adjust to fluctuating sales cycles, reduce risk, and make smarter business decisions—all while maintaining a forward-looking view of their financial health.

Best Practices for Forecasting in Diverse Revenue Models

Revenue models have evolved far beyond the traditional “one-time sale” paradigm. Many companies now operate on subscription, usage-based, or consumption-based models, each introducing additional layers of complexity into the forecasting process. These models require forecasting systems that can accommodate ongoing revenue streams, customer churn, contract renewals, and other factors that influence long-term financial health.

Best practices for revenue forecasting in complex models include:

- Segmentation by Revenue Type: Segment forecasts based on recurring vs. one-time revenue streams to enhance accuracy.

- Dynamic Forecasting: Adopt forecasting models that update in real-time as new data emerges, enabling agile decision-making. This is why forecasting in your CRM is valuable – it uses the most up-to-date information to improve accuracy.

- Cross-functional Collaboration: Ensure that finance, sales, and operations teams collaborate closely to align forecasts with broader business goals. Utilizing Salesforce (or another CRM) for this allows all eyes to have the most recent data and work collaboratively in real-time.

Holistic Revenue Insights

revVana’s Salesforce-native platform enables companies to integrate both sales and revenue forecasting, providing a comprehensive view of the entire revenue lifecycle—from pipeline to post-closure revenue streams. While propensity to close is a critical component of sales forecasting, it’s just one part of the equation. revVana takes this data and improves it by building more accurate revenue forecasts that go beyond deal closure, giving organizations the ability to forecast across different revenue models and adjust in real time.

By incorporating both propensity to close and a broader understanding of the full revenue picture, businesses can optimize forecasting, improve pipeline health, and increase growth potential.

Book a call with us today to see how revVana can help your business gain deeper insights into pipeline health and effectively manage complex revenue models—all within Salesforce.