When starting a SaaS company, managing finances often begins with basic systems and simple Profit and Loss (P&L) statements. Advanced financial tools may seem like an optional luxury, particularly when time is limited and resources are focused on core business operations. However, as the business grows, the need for more sophisticated financial management tools becomes apparent.

The Growing Need for Revenue Forecasting

Revenue forecasting becomes crucial as a SaaS business seeks to secure investments, obtain loans, or expand its operations. Investors and financial institutions require a clear picture of future revenue streams to assess the viability and potential of the business. Accurate revenue forecasting provides this clarity, making it an indispensable tool for growth and sustainability.

Revenue forecasting is not just about numbers; it’s about making informed decisions, planning effectively, and ensuring that the business aligns with its strategic goals. Accurate forecasts help businesses allocate resources efficiently, manage cash flow, and set realistic targets for growth.

The Forecasting Process

Effective revenue forecasting involves combining historical data, future assumptions, and professional judgment to predict revenue over a specific period. This process requires a thorough understanding of the business’s financial history, market conditions, and growth potential.

For businesses just starting out, simple spreadsheet models, such as those in Google Sheets or Excel can be very effective for mapping out marketing funnels and sales processes. These basic tools are accessible and easy to use, providing a good starting point for building revenue forecasts.

Revenue Forecasting Models

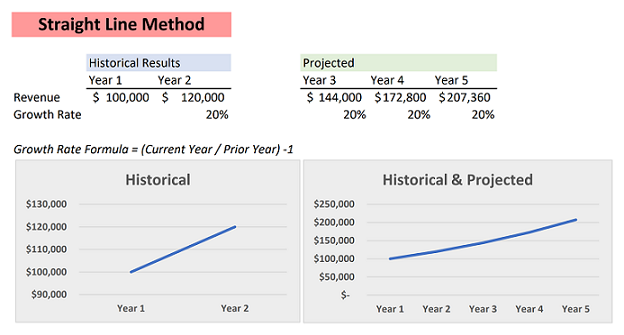

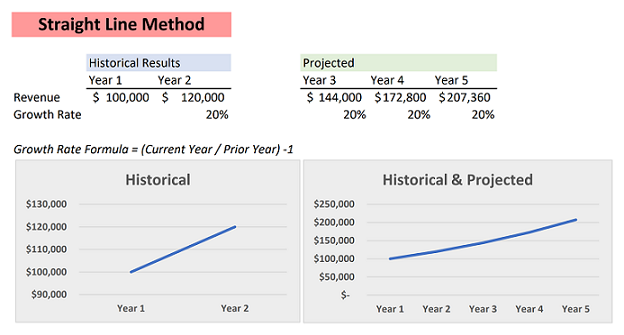

One basic forecasting technique is the straight-line method, which uses past data to project future revenue. While this method is straightforward and easy to implement, it may be too conservative for growing SaaS startups, which often experience rapid changes and growth, especially for SaaS companies operating with a usage-based pricing model.

Source: Insights For Professionals

As businesses grow, more advanced forecasting models become necessary. These models, such as those incorporating moving averages, better capture growth trends and adapt based on recent performance. They provide a more nuanced and accurate picture of future revenue.

Key Revenue Model Components

An effective revenue model includes several key components: customer acquisition, expansion, churn, and contraction rates. These factors all contribute to Monthly Recurring Revenue (MRR), a critical metric for SaaS businesses.

Maintaining Forecasts

To ensure accuracy, revenue forecasts should be regularly updated with fresh data and assumptions. This ongoing process helps to highlight deviations from expectations and allows businesses to make timely adjustments to their strategies.

Why SaaS Revenue Forecasting Should Be Done in Salesforce

While spreadsheets are useful initially, they can become complex and error-prone as the business grows. Additionally, as companies and teams grow, it becomes nearly impossible to have one consistent spreadsheet to track all revenue.

Using Salesforce for revenue forecasting allows for:

- Real-time Data: Immediate access to the latest sales data, ensuring forecasts are always up-to-date.

- Enhanced Accuracy: Leveraging Salesforce’s powerful data analytics to improve the accuracy of revenue predictions.

- Streamlined Processes: Reducing the need for manual data entry and the risk of errors associated with it.

- Scalability: As your business grows, Salesforce can scale with you, accommodating more complex forecasting needs without the limitations of spreadsheets.

Challenges of Forecasting in Salesforce

Salesforce’s forecasting tool is useful for predicting future sales revenue, but it has some drawbacks when it comes to revenue forecasting. Often, this process relies on spreadsheets that are error-prone and time-consuming, which can diminish the value of the software investment. Consequently, financial planning and analysis, as well as sales operations teams, may experience revenue visibility issues.

Creating revenue forecasts and reports manually increases the risk of human error, potentially affecting forecast accuracy. This is where a cloud-based solution like revVana’s Salesforce Revenue Forecasting comes into play. revVana translates forecasts from the pipeline and closed opportunities into revenue streams, automating and simplifying the revenue forecasting process. This integration provides real-time insights into CRM data and minimizes manual errors.

Salesforce + revVana

revVana saves time, reduces errors, and provides comprehensive insights by linking to financial reporting systems and handling complex data relationships. It streamlines the forecasting process and ensures that businesses have accurate, up-to-date information at their fingertips.

revVana’s solution leverages Salesforce’s robust CRM capabilities to provide real-time revenue forecasting directly within the platform. This integration ensures that all sales and financial data are seamlessly connected, providing a single source of truth for revenue projections.

SaaS revenue forecasting is a critical practice for growing businesses, and leveraging advanced tools like revVana and Salesforce can significantly enhance the accuracy and efficiency of your forecasting efforts.